inheritance tax changes 2021 uk

Such suggestions are a long way from becoming law and any changes to IHT of such a fundamental nature would need to be very carefully thought through and consulted upon by the government but the nature of the two reports might be seen to be an indication. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other.

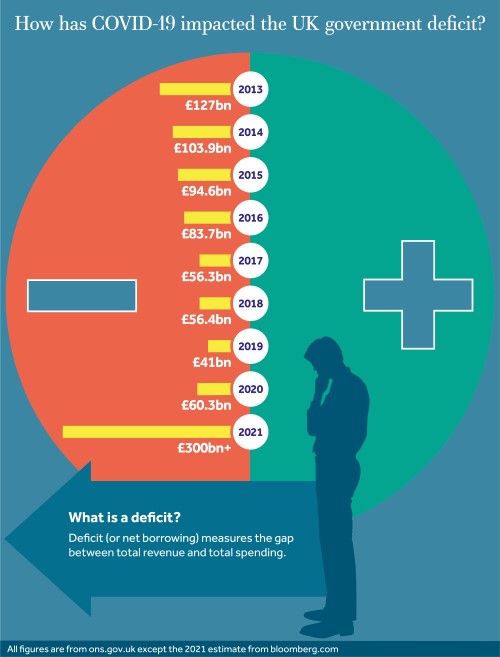

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

It has been suggested that income tax rates will be raised to as much as 45 and it is likely the CGT will increase to match it.

. For married couples they benefit from a cumulative NRB of 650000 2 x 325000. Changes to UK Inheritance Tax requirements for deaths after 1 January 2022. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances.

The estate can pay inheritance tax at a reduced rate of 36 on some assets if. The limit for chargeable trust property is increased from 150000 to 250000. Tell HMRC about houses land buildings.

Capital Gains Tax Rate UK 2021. Jointly owned assets IHT404 19 April 2016. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances.

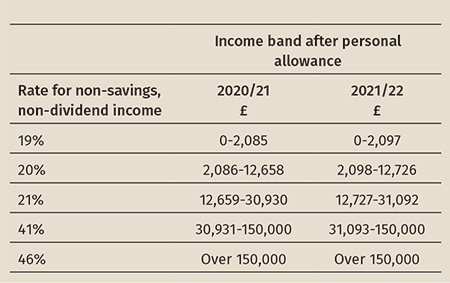

To reduce your Capital Gains Tax bill here are some practical steps. In addition to this there exists the residence nil rate band which is currently 150000 per person soon to be 175000 for the 20202021 tax year. Tax rates and allowances.

Inheritance tax changes 2021 uk Friday May 13 2022 Edit. Rates reliefs and responsibility. For exempt estates the value limit in relation to the gross value of the estate is increased from 1 million to.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The rate of IHT remains at 40. Gifts and other transfers of value IHT403 1 June 2020.

On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the requirements for many Personal Representatives when administering smaller non-taxpaying estates. Gifts in excess of 30000 would be taxed at 10. This measure maintains the tax-free thresholds and the residence nil rate band taper available for Inheritance Tax at their 2020 to 2021 tax year levels up to and including the tax year.

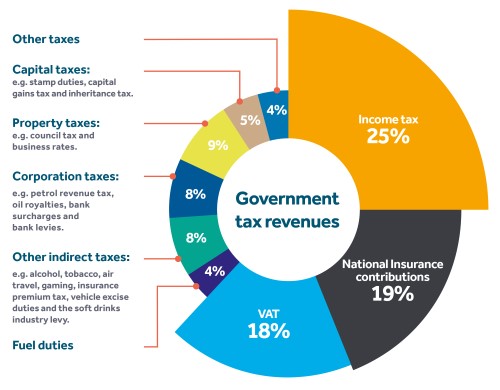

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. UK Inheritance Tax Reform. A recent report from the uk office of tax simplification ots following a review of the capital gains tax cgt has outlined some recommended changes to capital gains tax.

Read a copy of the government response to the first OTS Inheritance Tax review. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The residence nil rate band RNRB was due to start increasing in line. In March 2021 the government announced changes in IHT which will become effective from January 2022.

Inheritance Tax reporting requirements. Currently each person has a nil rate band NRB of 325000 up to which there is a 0 charge to IHT. Your estate is worth 500000 and your tax-free threshold is 325000.

Use your 12300 allowance which cannot be carried forward to future years. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic.

This is called entrepreneurs relief. On 23 March 2021 the government announced that later this year changes will. The estate can pay Inheritance Tax at a.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Often referred to colloquially as death tax it is a levy that is placed on estates that are worth more than the IHT threshold. For a table of the main tax rates and allowances for 20212022 click here.

Will inheritance tax change in 2021. A married couple can therefore raise. 07 January 2021.

The One Page Financial Plan Focusing Advice On What Matters Most Advicers Financial Planning How To Plan Family Values

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Budget Summary 2021 Key Points You Need To Know Budgeting Business Infographic Income Support

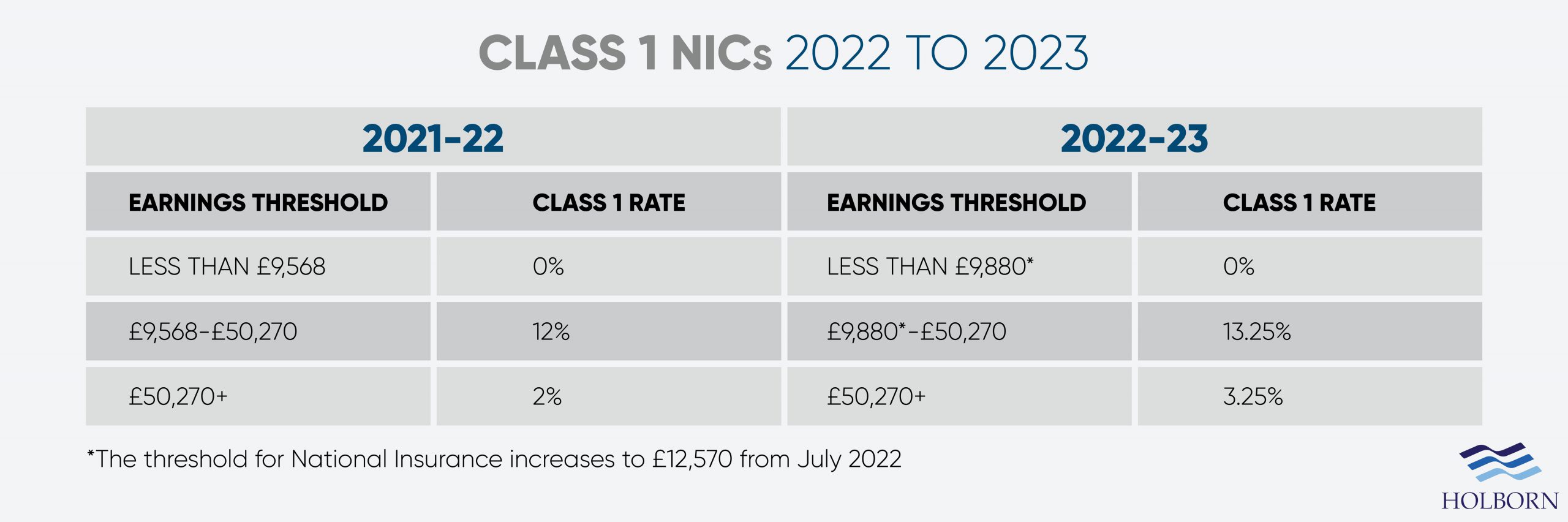

Changes To Uk Tax In 2022 Holborn Assets

Tax Rates And Tables 2021 22 Budget Edition Rebecca Cave Bloomsbury Professional

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Changes To Uk Tax In 2022 Holborn Assets

Comparing Property Tax Systems In Europe 2021 Tax Foundation

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Inheritance Tax The Seven Hmrc Exemptions Everyone Needs To Know In 2022 In 2022 Inheritance Tax Tax Mistakes Paying Taxes

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

The Telegraph Tax Guide 2021 Your Complete Guide To The Tax Return For 2020 21 Edition 45 Hardcover Walmart Com In 2022 Tax Guide Tax Return Inheritance Tax